The world’s Largest Sharp Brain Virtual Experts Marketplace Just a click Away

Levels Tought:

Elementary,Middle School,High School,College,University,PHD

| Teaching Since: | Apr 2017 |

| Last Sign in: | 56 Weeks Ago, 4 Days Ago |

| Questions Answered: | 7570 |

| Tutorials Posted: | 7352 |

BS,MBA, PHD

Adelphi University/Devry

Apr-2000 - Mar-2005

HOD ,Professor

Adelphi University

Sep-2007 - Apr-2017

True or False

1. The main limitation of the binomial model: its relatively slow calculation speed.

2. The Binomial Option Pricing Model (BOPM) can produce similar valuation results as the Black-Scholes model

3. Black-Scholes model can be used for pricing American put options

4. Black-Scholes model can be extended for pricing options on dividend-paying stock

5. The binomial model takes the time to expiration for an option and breaks it into a number of time intervals -

6. It is common practice to quote options by their implied volatility rather than their price.

7. Black-Sholes/Merton formula can be used to calculate the implied volatility.

8. The Black-Scholes formula for an European put option can be obtained from put-call parity.

9. Potential dividend payments do not affect option valuation.

Multiple Choice

10. Contracts that give the right, but not the obligation, to either buy or sell a specific underlying security for a specified price on or before a specific date.

11. Identify the assumptions of Black-Scholes/Merton Approach:

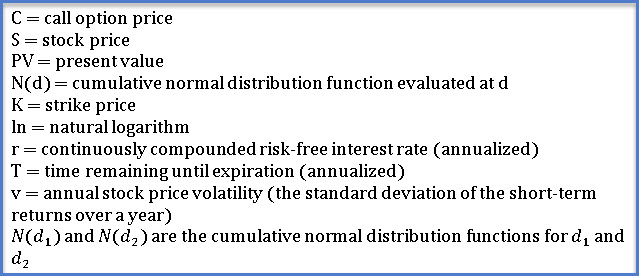

12. For a European call option, the Black-Scholes formula is:

13. Option valuation is done using:

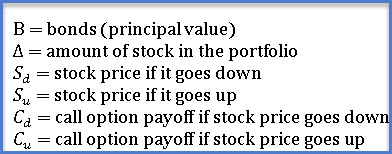

14. A General Formula for the One-Step Binomial Tree

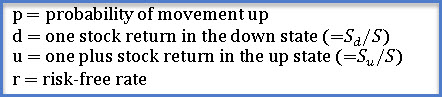

15. You are considering an American put option, strike price of $102, based on Alpha stock, which today is priced at $100. You assume that for each time step the stock price might move up or down 10 %. For the valuation, you will use two time steps, each one of 12 months. The risk-free annual compounded rate is at 4 %. The risk-neutral probability of an upward movement is:

16. A generalized formula for calculating probabilities can be derived as:

17. The upward movement in the option valuation:

18.Black-Scholes formula for an European put option, P, is the following:

19. Stock price = $100. The stock price can move up or down by 10 %. A tw0-step binomial tree is the following:

20. An option price is influenced by:

21. The value of the volatility of the underlying instrument which, when input in an option pricing model will return a theoretical value equal to the current market price of the option.

22. Asset price = $100, exercise price = asset price, maturity = 1 year, volatility = 0.015, risk-free rate = 1%, N(d1) = 0.7498973, N(d2) = 0.7451056. Call option price according to Black-Scholes model is:

23. Asset price = $50, exercise price = $50, volatility = 0.2376, maturity = 1 year, risk-free rate = 0.1 %. Call option price according to one-step binomial tree is:

24. Stock price = $100. The stock is expected to move up or down by 10 %, while p is the probability of upward movement. The expected future stock price is:

25. You are considering an American put option, strike price of $102, based on Alpha stock, which today is priced at $100. You assume that for each time step the stock price might move up or down by 10 %. For the valuation, you will use two time steps, each one of 12 months. The risk-free annual compounded rate is at 4 %. The two-step binomial for an American put is:

26. Identify the correct sentences about risk-neutral valuation:

27. Suppose you need to price a call option on a nondividend-paying stock with a price S1. The option has a strike price of x1 and a time to maturity of two years. The closest call option you can find trading in the markets is one on the same stock with the same strike price (x1) but with a six-month maturity. Option price is c1. The risk-free rate is r1. What are the required steps to price the option? 1. Obtain the volatility 2. Extrapolate from the model to calculate value of the two-year option. 3. Calibrate the Black-Scholes model such that it prices the traded option. You have all of the information for BS model except one: the stock volatility. Put in the value that causes the BS model to match c1 price.

Â