The world’s Largest Sharp Brain Virtual Experts Marketplace Just a click Away

Levels Tought:

Elementary,Middle School,High School,College,University,PHD

| Teaching Since: | May 2017 |

| Last Sign in: | 398 Weeks Ago, 2 Days Ago |

| Questions Answered: | 66690 |

| Tutorials Posted: | 66688 |

MCS,PHD

Argosy University/ Phoniex University/

Nov-2005 - Oct-2011

Professor

Phoniex University

Oct-2001 - Nov-2016

Indexation. (This problem follows Ball, 1988.) Suppose production at firm i is given by

Â

![]() Â Thus in logs,

Thus in logs,

Â

![]() Â Prices are flexible; thus (setting the constant term to 0 for simplicity)

Prices are flexible; thus (setting the constant term to 0 for simplicity)

Â

![]() Â Aggregating the output and price equations yields

Aggregating the output and price equations yields

Â

![]()  Wages are partially indexed to prices: w = θp, where 0 ≤ θ ≤ 1. Finally, aggregate demand is given by y = m − p. s and m are independent, mean-zero random variables with variances Vs and Vm.

Wages are partially indexed to prices: w = θp, where 0 ≤ θ ≤ 1. Finally, aggregate demand is given by y = m − p. s and m are independent, mean-zero random variables with variances Vs and Vm.

Â

(a) What are p,y,l, and was functions of m and s and the parameters α and θ? How does indexation affect the response of employment to monetary shocks? How does it affect the response to supply shocks?

Â

(b) What value of θ minimizes the variance of employment?

Â

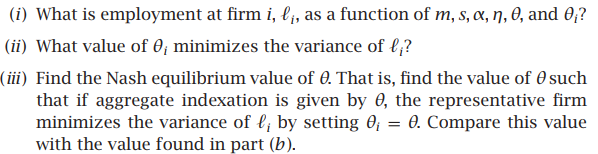

(c) Suppose the demand for a single firm’s output is ![]()  Suppose all firms other than firm i index their wages by w = θp as before, but that firm i indexes its wage by wi = θip. Firm i continues to set its price as

Suppose all firms other than firm i index their wages by w = θp as before, but that firm i indexes its wage by wi = θip. Firm i continues to set its price as ![]()  The production function and the pricing equation then imply that

The production function and the pricing equation then imply that ![]()

Â

Â

Â

Hel-----------lo -----------Sir-----------/Ma-----------dam-----------Tha-----------nk -----------You----------- fo-----------r u-----------sin-----------g o-----------ur -----------web-----------sit-----------e a-----------nd -----------acq-----------uis-----------iti-----------on -----------of -----------my -----------pos-----------ted----------- so-----------lut-----------ion-----------.Pl-----------eas-----------e p-----------ing----------- me----------- on-----------cha-----------t I----------- am----------- on-----------lin-----------e o-----------r i-----------nbo-----------x m-----------e a----------- me-----------ssa-----------ge -----------I w-----------ill----------- be-----------