The world’s Largest Sharp Brain Virtual Experts Marketplace Just a click Away

Levels Tought:

Elementary,Middle School,High School,College,University,PHD

| Teaching Since: | May 2017 |

| Last Sign in: | 398 Weeks Ago, 2 Days Ago |

| Questions Answered: | 66690 |

| Tutorials Posted: | 66688 |

MCS,PHD

Argosy University/ Phoniex University/

Nov-2005 - Oct-2011

Professor

Phoniex University

Oct-2001 - Nov-2016

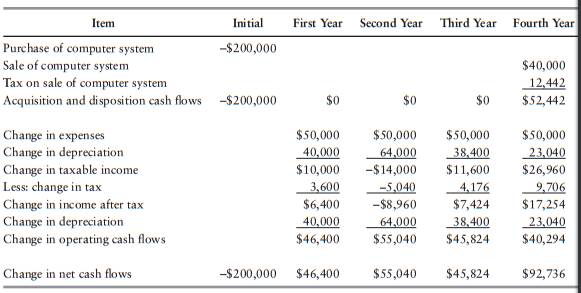

The financial manager of the Villard Electric Company, Fred Taylor, has presented his estimates of cash flows resulting from the possible investment in a new computer system, the Webnet. Mr. Taylor’s estimates of net cash flows immediately and over the following four years are as follows:

¬Ý

¬Ý

‚ñÝ The cost of the system (including installation) is $200,000.

¬Ý

‚ñÝ The system will be depreciated as a 5-year asset under the MACRS, but it will be sold at the end of the fourth year for $50,000.

¬Ý

‚ñÝ Villard‚Äôs expenses will decline by $50,000 in each of the four years.

¬Ý

‚ñÝ The company‚Äôs tax rate will be 36%.

¬Ý

‚ñÝ Working capital will not be affected. When he made his presentation to Villard‚Äôs board of directors, Mr. Taylor was asked to perform additional analyses to consider the following uncertainties:

¬Ý

‚ñÝ The cost of the system may be as much as 20% higher or as low as 20% lower.

¬Ý

‚ñÝ The change in expenses may be 30% higher or 20% lower than anticipated.

¬Ý

‚ñÝ The tax rate may be lowered to 30%.

¬Ý

a. Reestimate the project’s cash flows to consider each of the possible variations in the assumptions, altering only one assumption each time. Using a spreadsheet program will help with the calculations.

¬Ý

b. Discuss the impact that each of the changes in assumptions has on the project’s cash flows.

¬Ý

Hel-----------lo -----------Sir-----------/Ma-----------dam-----------Tha-----------nk -----------You----------- fo-----------r u-----------sin-----------g o-----------ur -----------web-----------sit-----------e a-----------nd -----------acq-----------uis-----------iti-----------on -----------of -----------my -----------pos-----------ted----------- so-----------lut-----------ion-----------.Pl-----------eas-----------e p-----------ing----------- me----------- on-----------cha-----------t I----------- am----------- on-----------lin-----------e o-----------r i-----------nbo-----------x m-----------e a----------- me-----------ssa-----------ge -----------I w-----------ill----------- be-----------