The world’s Largest Sharp Brain Virtual Experts Marketplace Just a click Away

Levels Tought:

Elementary,Middle School,High School,College,University,PHD

| Teaching Since: | May 2017 |

| Last Sign in: | 398 Weeks Ago, 3 Days Ago |

| Questions Answered: | 66690 |

| Tutorials Posted: | 66688 |

MCS,PHD

Argosy University/ Phoniex University/

Nov-2005 - Oct-2011

Professor

Phoniex University

Oct-2001 - Nov-2016

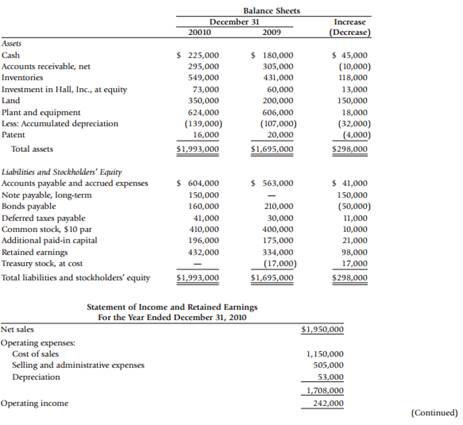

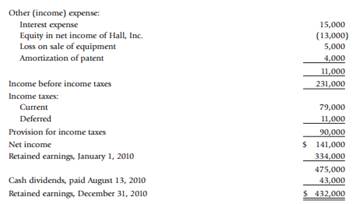

Comprehensive The following are the balance sheets of Farrell Corporation as of December 31, 2010 and 2009, and the statement of income and retained earnings for the year ended December 31, 2010:

Additional information:

1. On January 2, 2010, Farrell sold equipment costing $45,000, with a book value of $24,000, for $19,000 cash.

2. On April 2, 2010, Farrell issued 1,000 shares of common stock for $23,000 cash.

3. On May 14, 2010, Farrell sold all of its treasury stock for $25,000 cash.

4. On June 1, 2010, Farrell paid $50,000 to retire bonds with a face value (and book value) of $50,000.

5. On July 2, 2010, Farrell purchased equipment for $63,000 cash.

6. On December 31, 2010, land with a fair market value of $150,000 was purchased through the issuance of a long-term note in the amount of $150,000. The note bears interest at the rate of 15% and is due on December 31, 2015.

7. Deferred taxes payable represent temporary differences relating to the use of accelerated depreciation methods for income tax reporting and the straight-line method for financial statement reporting

Required

1. Prepare a worksheet (spreadsheet) to support a statement of cash flows for the Farrell Corporation for the year ended December 31, 2010, based on the preceding information.

2. Prepare the statement of cash flows.

Hel-----------lo -----------Sir-----------/Ma-----------dam-----------Tha-----------nk -----------You----------- fo-----------r u-----------sin-----------g o-----------ur -----------web-----------sit-----------e a-----------nd -----------acq-----------uis-----------iti-----------on -----------of -----------my -----------pos-----------ted----------- so-----------lut-----------ion-----------.Pl-----------eas-----------e p-----------ing----------- me----------- on-----------cha-----------t I----------- am----------- on-----------lin-----------e o-----------r i-----------nbo-----------x m-----------e a----------- me-----------ssa-----------ge -----------I w-----------ill----------- be-----------