The world’s Largest Sharp Brain Virtual Experts Marketplace Just a click Away

Levels Tought:

Elementary,Middle School,High School,College,University,PHD

| Teaching Since: | May 2017 |

| Last Sign in: | 398 Weeks Ago, 1 Day Ago |

| Questions Answered: | 66690 |

| Tutorials Posted: | 66688 |

MCS,PHD

Argosy University/ Phoniex University/

Nov-2005 - Oct-2011

Professor

Phoniex University

Oct-2001 - Nov-2016

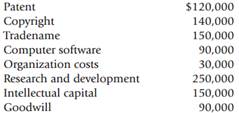

Intangibles The Bailey Company was formed in January 2008 and is preparing its financial statements under GAAP for the first time at the end of 2010. Its general ledger at December 31, 2010, includes the following assets:

As the recently hired accountant for the company, you have been asked to make sure that the company’s accounting for intangibles follows GAAP. You know that because the company has never issued financial statements according to GAAP, any adjustments that are made to correct violations of GAAP are recorded as an adjustment to its retained earnings. You determine that the patent has an expected life of 15 years at the end of 2010 and no residual value, and that it will generate approximately equal benefits each year. You also determine that the company will use the copyright and tradename for the foreseeable future. The computer software is used in the company’s 20 offices around the country; it was replaced in 40% of the offices in 2010 and will be replaced in the remaining offices next year. On further examination, you find that the company had previously capitalized the expected value of its “human resources” as intellectual capital, with a corresponding increase in additional paid-in capital.

You also determine that the tradename and goodwill arose from an acquisition of a subsidiary company at the end of 2009. Because of a significant adverse change in the market, you decide that both assets are impaired. You estimate that the fair value of the tradename is $50,000. The subsidiary company has a book value of $500,000, including the goodwill of $90,000. You estimate that the subsidiary’s fair value is $300,000, of which $250,000 is allocated to its identifiable assets and liabilities.

Required

Prepare journal entries to provide the correct information under GAAP at the end of 2010.

Â

Hel-----------lo -----------Sir-----------/Ma-----------dam-----------Tha-----------nk -----------You----------- fo-----------r u-----------sin-----------g o-----------ur -----------web-----------sit-----------e a-----------nd -----------acq-----------uis-----------iti-----------on -----------of -----------my -----------pos-----------ted----------- so-----------lut-----------ion-----------.Pl-----------eas-----------e p-----------ing----------- me----------- on-----------cha-----------t I----------- am----------- on-----------lin-----------e o-----------r i-----------nbo-----------x m-----------e a----------- me-----------ssa-----------ge -----------I w-----------ill----------- be-----------