The world’s Largest Sharp Brain Virtual Experts Marketplace Just a click Away

Levels Tought:

Elementary,Middle School,High School,College,University,PHD

| Teaching Since: | May 2017 |

| Last Sign in: | 399 Weeks Ago, 1 Day Ago |

| Questions Answered: | 66690 |

| Tutorials Posted: | 66688 |

MCS,PHD

Argosy University/ Phoniex University/

Nov-2005 - Oct-2011

Professor

Phoniex University

Oct-2001 - Nov-2016

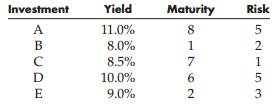

A trust officer at Pond Island Bank needs to determine what percentage of the bank’s investable funds to place in each of following investments.

The Yield column represents each investment’s annual yield. The Maturity column indicates the number of years funds must be placed in each investment. The Risk column indicates an independent financial analyst’s assessment of each investment’s risk. In general, the trust officer wants to maximize the weighted average yield on the funds placed in these investments while minimizing the weighted average maturity and the weighted average risk.

a. Formulate an MOLP model for this problem, and implement your model in a spreadsheet.

b. Determine the best possible value for each objective in the problem.

c. Determine the solution that minimizes the maximum percentage deviation from the optimal objective function values. What solution do you obtain?

d. Suppose management considers minimizing the average maturity to be twice as important as minimizing average risk, and maximizing average yield to be twice as important as minimizing average maturity. What solution does this suggest?

Â

Hel-----------lo -----------Sir-----------/Ma-----------dam-----------Tha-----------nk -----------You----------- fo-----------r u-----------sin-----------g o-----------ur -----------web-----------sit-----------e a-----------nd -----------acq-----------uis-----------iti-----------on -----------of -----------my -----------pos-----------ted----------- so-----------lut-----------ion-----------.Pl-----------eas-----------e p-----------ing----------- me----------- on-----------cha-----------t I----------- am----------- on-----------lin-----------e o-----------r i-----------nbo-----------x m-----------e a----------- me-----------ssa-----------ge -----------I w-----------ill----------- be-----------