The world’s Largest Sharp Brain Virtual Experts Marketplace Just a click Away

Levels Tought:

Elementary,Middle School,High School,College,University,PHD

| Teaching Since: | May 2017 |

| Last Sign in: | 398 Weeks Ago, 3 Days Ago |

| Questions Answered: | 66690 |

| Tutorials Posted: | 66688 |

MCS,PHD

Argosy University/ Phoniex University/

Nov-2005 - Oct-2011

Professor

Phoniex University

Oct-2001 - Nov-2016

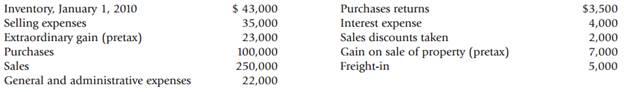

Cost of Goods Sold and Income Statement The Fanta Company presents you with the following account balances taken from its December 31, 2010 adjusted trial balance:

Additional data:

1. A physical count reveals an ending inventory of $22,500 on December 31, 2010.

2. Twenty-five thousand shares of common stock have been outstanding the entire year.

3. The income tax rate is 30% on all items of income.

Required

1. As a supporting document for Requirements 2 and 3, prepare a separate schedule for Fanta  Company’s cost of goods sold.

2. Prepare a 2010 multiple-step income statement.

3. Prepare a 2010 single-step income statement.

Hel-----------lo -----------Sir-----------/Ma-----------dam-----------Tha-----------nk -----------You----------- fo-----------r u-----------sin-----------g o-----------ur -----------web-----------sit-----------e a-----------nd -----------acq-----------uis-----------iti-----------on -----------of -----------my -----------pos-----------ted----------- so-----------lut-----------ion-----------.Pl-----------eas-----------e p-----------ing----------- me----------- on-----------cha-----------t I----------- am----------- on-----------lin-----------e o-----------r i-----------nbo-----------x m-----------e a----------- me-----------ssa-----------ge -----------I w-----------ill----------- be-----------