The world’s Largest Sharp Brain Virtual Experts Marketplace Just a click Away

Levels Tought:

Elementary,Middle School,High School,College,University,PHD

| Teaching Since: | May 2017 |

| Last Sign in: | 399 Weeks Ago |

| Questions Answered: | 66690 |

| Tutorials Posted: | 66688 |

MCS,PHD

Argosy University/ Phoniex University/

Nov-2005 - Oct-2011

Professor

Phoniex University

Oct-2001 - Nov-2016

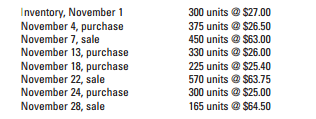

Inventory Costing Methods—Periodic System

Story Company’s inventory records for the month of November reveal the following:

Selling and administrative expenses for the month were $16,200. Depreciation expense was

$6,000. Story’s tax rate is 35%.

Required

1. Calculate the cost of goods sold and ending inventory under each of the following three methods

assuming a periodic inventory system: (a) FIFO, (b) LIFO, and (c) weighted average.

2. Calculate the gross profit and net income under each costing assumption.

3. Under which costing method will Story pay the least taxes? Explain your answer.

Â

Hel-----------lo -----------Sir-----------/Ma-----------dam-----------Tha-----------nk -----------You----------- fo-----------r u-----------sin-----------g o-----------ur -----------web-----------sit-----------e a-----------nd -----------acq-----------uis-----------iti-----------on -----------of -----------my -----------pos-----------ted----------- so-----------lut-----------ion-----------.Pl-----------eas-----------e p-----------ing----------- me----------- on-----------cha-----------t I----------- am----------- on-----------lin-----------e o-----------r i-----------nbo-----------x m-----------e a----------- me-----------ssa-----------ge -----------I w-----------ill----------- be-----------