The world’s Largest Sharp Brain Virtual Experts Marketplace Just a click Away

Levels Tought:

Elementary,Middle School,High School,College,University,PHD

| Teaching Since: | May 2017 |

| Last Sign in: | 398 Weeks Ago, 6 Days Ago |

| Questions Answered: | 66690 |

| Tutorials Posted: | 66688 |

MCS,PHD

Argosy University/ Phoniex University/

Nov-2005 - Oct-2011

Professor

Phoniex University

Oct-2001 - Nov-2016

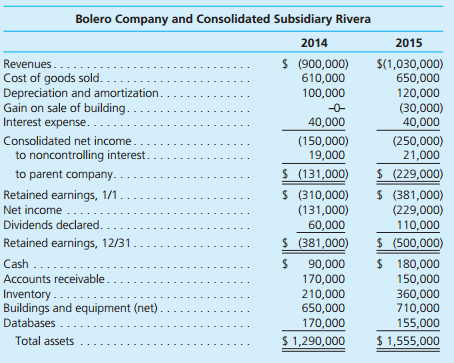

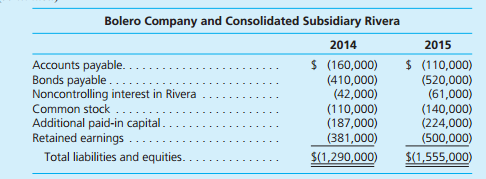

Bolero Company holds 80 percent of the common stock of Rivera, Inc., and 40 percent of this subsidiary’s convertible bonds. The following consolidated financial statements are for 2014 and 2015:  Â

Â Â Â Â Â Â Â Â

Â

Additional Information for 2015

• The parent issued bonds during the year for cash.

• Amortization of databases amounts to $15,000 per year.

• The parent sold a building with a cost of $80,000 but a $40,000 book value for cash on May 11.

• The subsidiary purchased equipment on July 23 for $205,000 in cash.

• Late in November, the parent issued stock for cash.

• During the year, the subsidiary paid dividends of $10,000. Both parent and subsidiary pay dividends in the same year as declared. Prepare a consolidated statement of cash flows for this business combination for the year ending December 31, 2015. (Use indirect method)

Hel-----------lo -----------Sir-----------/Ma-----------dam-----------Tha-----------nk -----------You----------- fo-----------r u-----------sin-----------g o-----------ur -----------web-----------sit-----------e a-----------nd -----------acq-----------uis-----------iti-----------on -----------of -----------my -----------pos-----------ted----------- so-----------lut-----------ion-----------.Pl-----------eas-----------e p-----------ing----------- me----------- on-----------cha-----------t I----------- am----------- on-----------lin-----------e o-----------r i-----------nbo-----------x m-----------e a----------- me-----------ssa-----------ge -----------I w-----------ill----------- be-----------