The world’s Largest Sharp Brain Virtual Experts Marketplace Just a click Away

Levels Tought:

Elementary,Middle School,High School,College,University,PHD

| Teaching Since: | May 2017 |

| Last Sign in: | 398 Weeks Ago, 2 Days Ago |

| Questions Answered: | 66690 |

| Tutorials Posted: | 66688 |

MCS,PHD

Argosy University/ Phoniex University/

Nov-2005 - Oct-2011

Professor

Phoniex University

Oct-2001 - Nov-2016

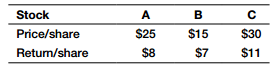

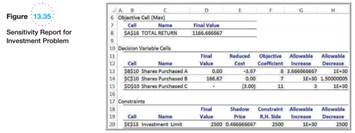

Figure 13.35 shows the Solver sensitivity report for the investment scenario in Problem 4. Using only the information in the sensitivity report, answer the following questions.

a. How much would the return on stock A have to increase to invest fully in that stock?

b. How much would the return on stock C have to be to invest fully in that stock?

c. Explain the value of the shadow price for the total investment constraint. If the student could borrow $1,000 at 8% a year to increase her total investment, what would you recommend and why?

Problem 4:

A business student has $2,500 available from a summer job and has identified three potential stocks in which to invest. The cost per share and expected return over the next 2 years is given in the table.

a. Identify the decision variables, objective function, and constraints in simple verbal statements.

b. Mathematically formulate a linear optimization model.

Â

Hel-----------lo -----------Sir-----------/Ma-----------dam-----------Tha-----------nk -----------You----------- fo-----------r u-----------sin-----------g o-----------ur -----------web-----------sit-----------e a-----------nd -----------acq-----------uis-----------iti-----------on -----------of -----------my -----------pos-----------ted----------- so-----------lut-----------ion-----------.Pl-----------eas-----------e p-----------ing----------- me----------- on-----------cha-----------t I----------- am----------- on-----------lin-----------e o-----------r i-----------nbo-----------x m-----------e a----------- me-----------ssa-----------ge -----------I w-----------ill----------- be-----------