The world’s Largest Sharp Brain Virtual Experts Marketplace Just a click Away

Levels Tought:

Elementary,Middle School,High School,College,University,PHD

| Teaching Since: | May 2017 |

| Last Sign in: | 398 Weeks Ago, 6 Days Ago |

| Questions Answered: | 66690 |

| Tutorials Posted: | 66688 |

MCS,PHD

Argosy University/ Phoniex University/

Nov-2005 - Oct-2011

Professor

Phoniex University

Oct-2001 - Nov-2016

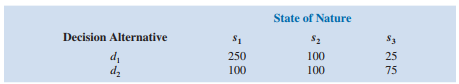

The following profit payoff table was presented in Problem 1.

The probabilities for the states of nature are P(s1) 5 0.65, P(s2) 5 0.15, and P(s3) 5 0.20. a. What is the optimal decision strategy if perfect information were available?

b. What is the expected value for the decision strategy developed in part a?

c. Using the expected value approach, what is the recommended decision without perfect information? What is its expected value?

d. What is the expected value of perfect information?

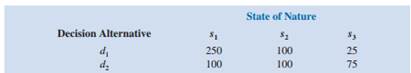

Problem 1

The following payoff table shows profit for a decision analysis problem with two decision alternatives and three states of nature:

a. Construct a decision tree for this problem.

b. If the decision maker knows nothing about the probabilities of the three states of nature, what is the recommended decision using the optimistic, conservative, and minimax regret approaches?

Â

Hel-----------lo -----------Sir-----------/Ma-----------dam-----------Tha-----------nk -----------You----------- fo-----------r u-----------sin-----------g o-----------ur -----------web-----------sit-----------e a-----------nd -----------acq-----------uis-----------iti-----------on -----------of -----------my -----------pos-----------ted----------- so-----------lut-----------ion-----------.Pl-----------eas-----------e p-----------ing----------- me----------- on-----------cha-----------t I----------- am----------- on-----------lin-----------e o-----------r i-----------nbo-----------x m-----------e a----------- me-----------ssa-----------ge -----------I w-----------ill----------- be-----------