The world’s Largest Sharp Brain Virtual Experts Marketplace Just a click Away

Levels Tought:

Elementary,Middle School,High School,College,University,PHD

| Teaching Since: | May 2017 |

| Last Sign in: | 398 Weeks Ago, 6 Days Ago |

| Questions Answered: | 66690 |

| Tutorials Posted: | 66688 |

MCS,PHD

Argosy University/ Phoniex University/

Nov-2005 - Oct-2011

Professor

Phoniex University

Oct-2001 - Nov-2016

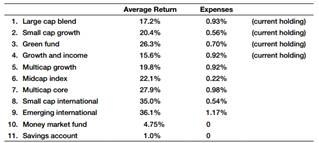

A recent MBA graduate, Dara, has gained control over custodial accounts that her parents had established. Currently, her money is invested in four funds, but she has identified several other funds as options for investment. She has $100,000 to invest with the following restrictions:

• Keep at least $5,000 in savings.

• Invest at least 14% in the money market fund.

• Invest at least 16% in international funds.

• Keep 35% of funds in current holdings.

• Do not allocate more than 20% of funds to any one investment except for the money market and savings account.

• Allocate at least 30% into new investments.            Â

a. Develop a linear optimization model to maximize the net return.

b. Interpret the Sensitivity report.

c. Use Solver’s parameter-analysis method to investigate different assumptions about the portfolio constraints.

d. Summarize your results and write a short memo in nontechnical language to Dara.

Â

Hel-----------lo -----------Sir-----------/Ma-----------dam-----------Tha-----------nk -----------You----------- fo-----------r u-----------sin-----------g o-----------ur -----------web-----------sit-----------e a-----------nd -----------acq-----------uis-----------iti-----------on -----------of -----------my -----------pos-----------ted----------- so-----------lut-----------ion-----------.Pl-----------eas-----------e p-----------ing----------- me----------- on-----------cha-----------t I----------- am----------- on-----------lin-----------e o-----------r i-----------nbo-----------x m-----------e a----------- me-----------ssa-----------ge -----------I w-----------ill----------- be-----------