The world’s Largest Sharp Brain Virtual Experts Marketplace Just a click Away

Levels Tought:

Elementary,Middle School,High School,College,University,PHD

| Teaching Since: | May 2017 |

| Last Sign in: | 398 Weeks Ago, 5 Days Ago |

| Questions Answered: | 66690 |

| Tutorials Posted: | 66688 |

MCS,PHD

Argosy University/ Phoniex University/

Nov-2005 - Oct-2011

Professor

Phoniex University

Oct-2001 - Nov-2016

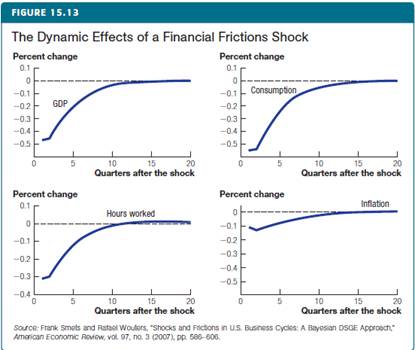

Relating DSGE and AS/AD for a financial friction shock: Consider the complete dynamic response of the economy to a temporary rise in financial frictions in the AS/AD framework.

(a) Draw the AS/AD graph associated with this shock.

(b) Plot the impulse response function of GDP to this shock, according to the AS/AD model. You do not need to worry about numbers on the vertical axis; just show the general pattern as the economy moves after the shock and eventually returns to steady state.

(c) Plot the impulse response function of inflation to this shock, according to the AS/AD model.

(d) Compare your results in these two stylized plots to the impulse response function from the Smets-Wouters model shown in Figure 15.13.

Hel-----------lo -----------Sir-----------/Ma-----------dam-----------Tha-----------nk -----------You----------- fo-----------r u-----------sin-----------g o-----------ur -----------web-----------sit-----------e a-----------nd -----------acq-----------uis-----------iti-----------on -----------of -----------my -----------pos-----------ted----------- so-----------lut-----------ion-----------.Pl-----------eas-----------e p-----------ing----------- me----------- on-----------cha-----------t I----------- am----------- on-----------lin-----------e o-----------r i-----------nbo-----------x m-----------e a----------- me-----------ssa-----------ge -----------I w-----------ill----------- be-----------