The world’s Largest Sharp Brain Virtual Experts Marketplace Just a click Away

Levels Tought:

Elementary,Middle School,High School,College,University,PHD

| Teaching Since: | May 2017 |

| Last Sign in: | 401 Weeks Ago, 6 Days Ago |

| Questions Answered: | 66690 |

| Tutorials Posted: | 66688 |

MCS,PHD

Argosy University/ Phoniex University/

Nov-2005 - Oct-2011

Professor

Phoniex University

Oct-2001 - Nov-2016

Consider the following two banks: ( LG 3-4 )

Bank 1 has assets composed solely of a 10-year, 12 percent coupon, $1 million loan with a 12 percent yield to maturity. It is financed with a 10-year, 10 percent coupon, $1 million CD with a 10 percent yield to maturity.

Bank 2 has assets composed solely of a 7-year, 12 percent, zero-coupon bond with a current value of $894,006.20 and a maturity value of $1,976,362.88. It is financed by a 10-year, 8.275 percent coupon, $1,000,000 face value CD with a yield to maturity of 10 percent.

All securities except the zero-coupon bond pay interest annually

a. If interest rates rise by 1 percent (100 basis points), how do the values of the assets and liabilities of each bank change?

b. What accounts for the differences between the two banks’ accounts?

( LG 3-4)

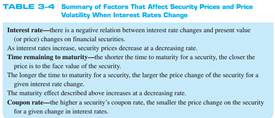

As already discussed in this chapter and in Chapter 2 , the variability of financial security prices depends on interest rates and the characteristics of the security. Specifically, the factors that affect financial security prices include interest rate changes, the time remaining to maturity, and the coupon rate. We evaluate next the impact of each of these factors as they affect bond prices. The impact on equity prices is similar. Table 3‚Äď4 summarizes the major relationships we will be discussing.

Hel-----------lo -----------Sir-----------/Ma-----------dam-----------Tha-----------nk -----------You----------- fo-----------r u-----------sin-----------g o-----------ur -----------web-----------sit-----------e a-----------nd -----------acq-----------uis-----------iti-----------on -----------of -----------my -----------pos-----------ted----------- so-----------lut-----------ion-----------.Pl-----------eas-----------e p-----------ing----------- me----------- on-----------cha-----------t I----------- am----------- on-----------lin-----------e o-----------r i-----------nbo-----------x m-----------e a----------- me-----------ssa-----------ge -----------I w-----------ill----------- be-----------