The world’s Largest Sharp Brain Virtual Experts Marketplace Just a click Away

Levels Tought:

Elementary,Middle School,High School,College,University,PHD

| Teaching Since: | May 2017 |

| Last Sign in: | 399 Weeks Ago |

| Questions Answered: | 66690 |

| Tutorials Posted: | 66688 |

MCS,PHD

Argosy University/ Phoniex University/

Nov-2005 - Oct-2011

Professor

Phoniex University

Oct-2001 - Nov-2016

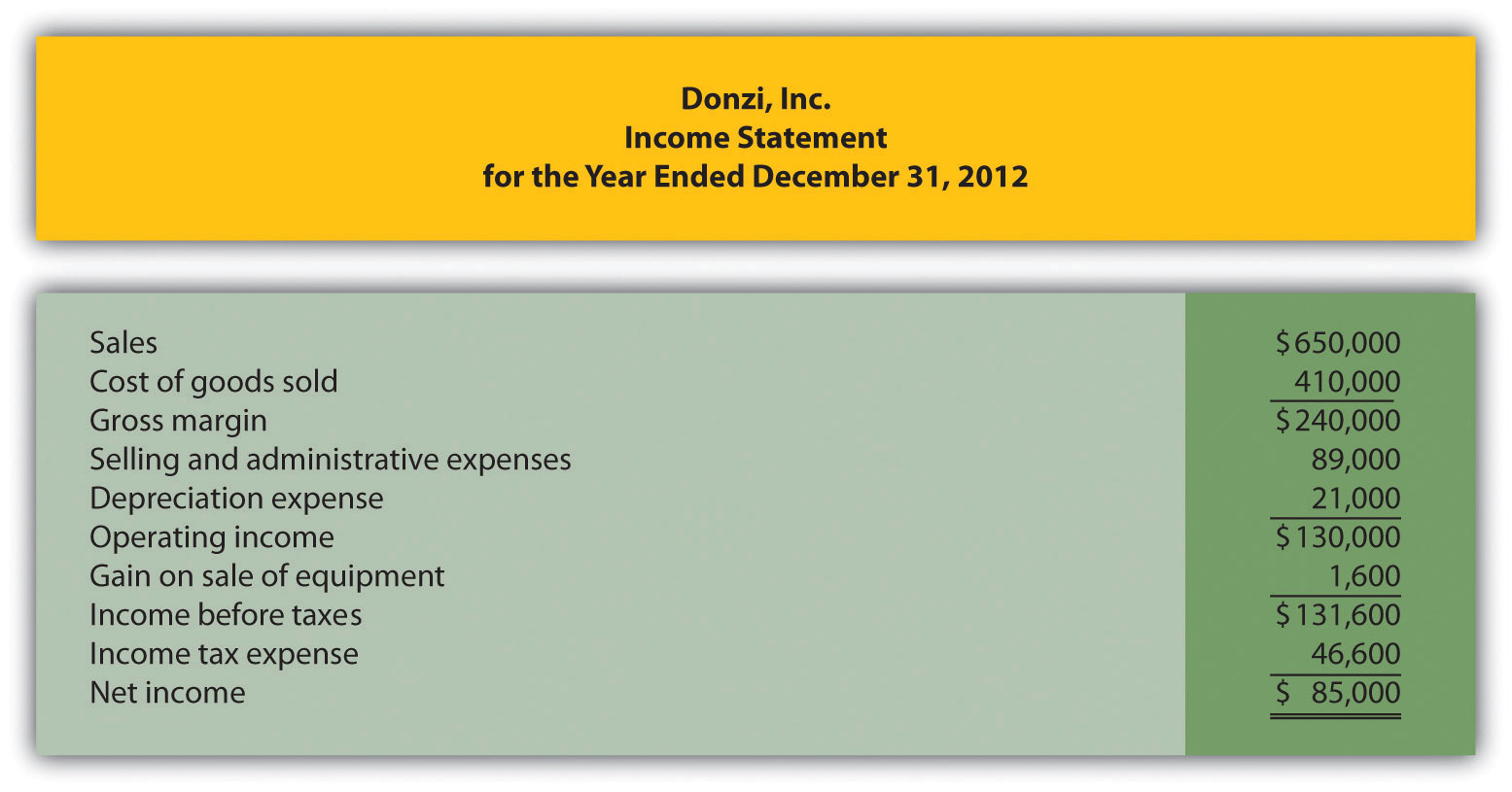

19.¬ÝOperating Activities Section Using the Indirect Method.¬ÝThe following income statement and current sections of the balance sheet are for Donzi, Inc.

Required:

Using the indirect method, prepare the operating activities section of the statement of cash flows for Donzi, Inc., for the year ended December 31, 2012. Use the format presented in Figure 12.5 "Operating Activities Section of Statement of Cash Flows (Home Store, Inc.)".

Prepare the financing activities section of the statement of cash flows for Canton Company for the year ended December 31, 2012. Use the format presented in Figure 12.7 "Financing Activities Section of State36.¬ÝProfitability and Short-Term Liquidity Ratios.¬ÝRefer to the information presented in Problem 35 for¬ÝNordstrom.

Required:

Compute the following profitability ratios for 2010, and provide a brief explanation after each ratio (round percentage computations to one decimal place and earnings per share to two decimal places):

Compute the following short-term liquidity ratios for 2010, and provide a brief explanation after each ratio (round computations to two decimal places):

37. Long-Term Solvency Ratios and Market Valuation Measures.¬ÝRefer to the information presented in Problem 35 for¬ÝNordstrom.

Required:

Compute the following long-term solvency ratios for 2010, and provide a brief explanation after each ratio (round computations to two decimal places):

Compute the following market valuation measures for 2010, and provide a brief explanation after each measure (state market capitalization in billions, and round price-earnings ratio to two decimal places):

ment of Cash Flows (Home Store, Inc.)".

Hel-----------lo -----------Sir-----------/Ma-----------dam----------- ¬-----------Ý -----------Tha-----------nk -----------You----------- fo-----------r u-----------sin-----------g o-----------ur -----------web-----------sit-----------e a-----------nd -----------acq-----------uis-----------iti-----------on -----------of -----------my -----------pos-----------ted----------- so-----------lut-----------ion-----------. P-----------lea-----------se -----------pin-----------g m-----------e o-----------n c-----------hat----------- I -----------am -----------onl-----------ine----------- or----------- in-----------box----------- me----------- a -----------mes-----------sag-----------e I----------- wi-----------ll